Back to Nature: Cannabis Consumers Gain Satisfaction in Outdoor Settings

By Amanda Reiman, Chief Knowledge Officer, and J.J. McCoy, Senior Managing Editor, New Frontier Data

In ways that extend well beyond either drinking beer or the use of wine for cooking or possible benefit for an imbiber’s heart and blood circulation, cannabis consumers are increasingly intentional about pursuing a diverse range of goals, practices, and experiences with the plant.

To help the legal cannabis industry better understand its clientele, New Frontier Data — in partnership with cannabis discovery company Jointly — has released Cannabis Consumers in America: (Part II) The Purposeful Consumer, the second report in a three-part series about U.S. consumers and their intentions, preferences, and behaviors.

While factors including age, gender, and desired outcomes all play their roles in determining preferences among cannabis products, today’s cannabis consumer seeks very specific effects. Whether those include relaxation, pain management, or enhancing a social experience, it’s vitally important for anyone competing in the market to recognize the value in addressing them: For producers and marketers, tailoring their brands to those specifically sought effects and experiences is fundamental to creating and maintaining meaningful connections to their customers.

Since Jointly launched its consumer data platform in 2020, some 80,000 cannabis consumers have rated and recorded their individual experiences. To date, more than 206,000 of them have documented experiences detailing goals, products, doses, product effectiveness, and flavor/aroma ratings. They include 140,000 experiences noting the time of day, duration since a previous session, the presence or absence of exercise, hours of sleep, hydration, fullness of stomach, and side effects.

Natural Settings Linked to Satisfaction

As shared among the report’s findings, in fully half (50%) of reported use sessions, consumers were alone. The next most common use sessions included sharing with companions — ranging from significant others (22%), to friends (15%), or family (10%).

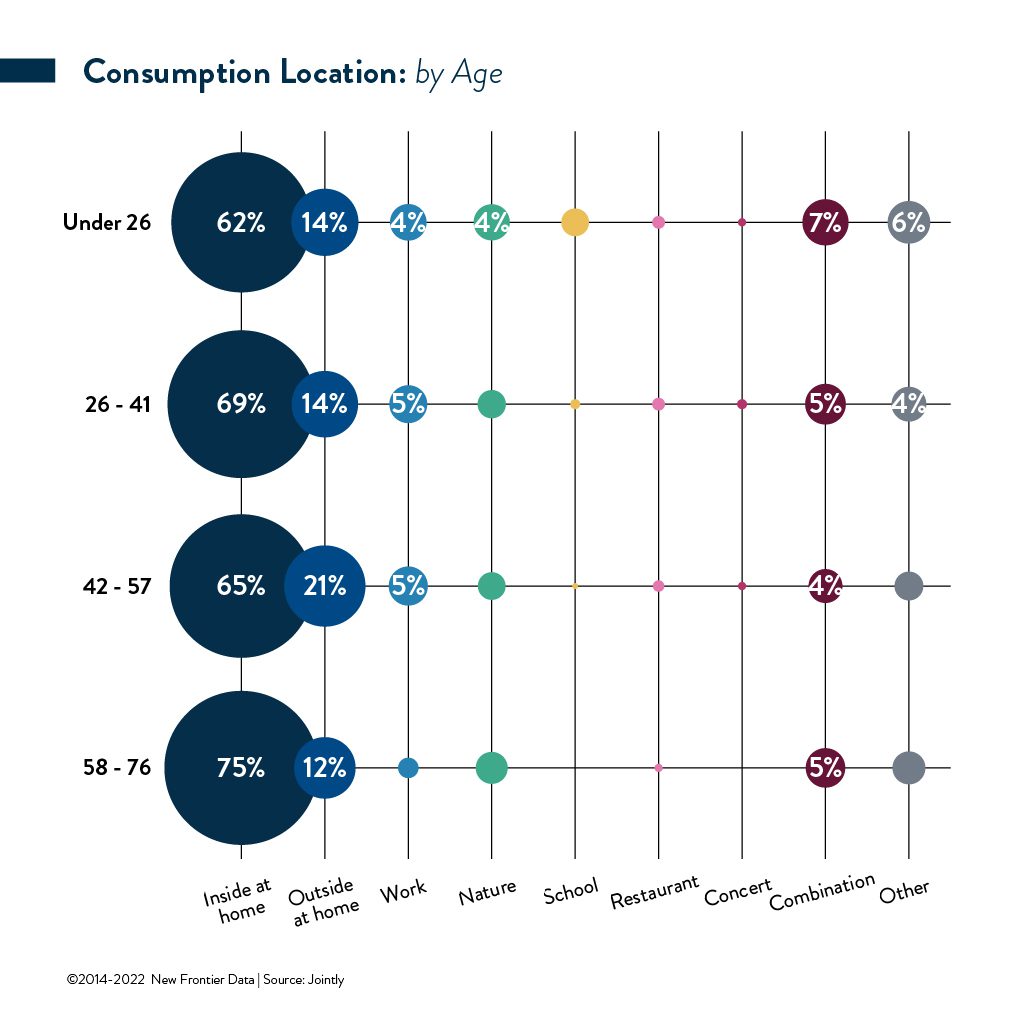

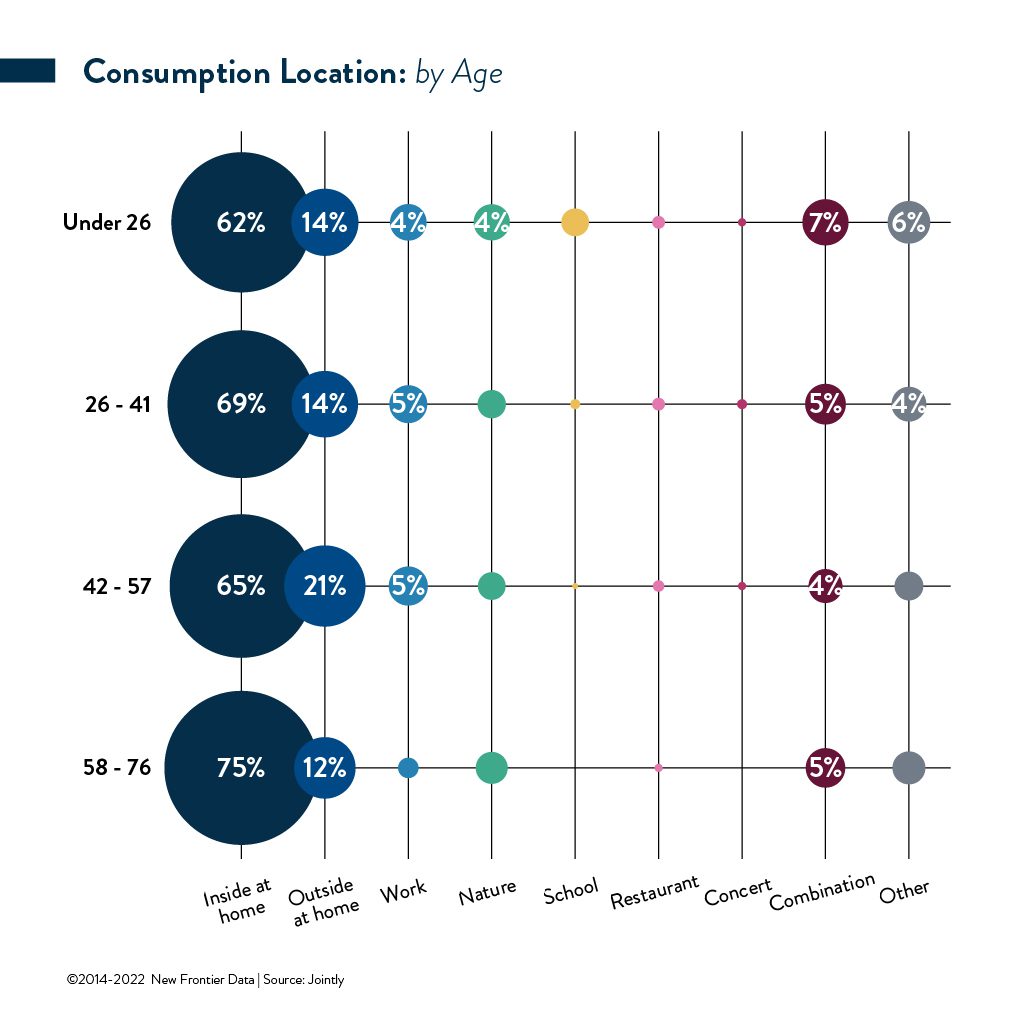

Consumers aged 42-57 represent those most likely to purposefully consume cannabis alone. Ages 58-76 report being most likely to use cannabis with their significant others, while those under 26 are likeliest to report consuming it with friends. Ages 58-76 are also the likeliest cohort to report consuming at home. Curiously though, while consuming at home is also predominant for the 42-57 age group, those consumers are the most likely segment to partake outside the home. This may be due to those on the younger end of the age cohort having minors at home, motivating a search for places to consume apart from them.

However it is that respective motives shape consumer patterns, parsing those preferences represent some significant opportunities. While home was the most common location for consumption, a natural setting was the venue where consumption goals were most often met. This presents interesting opportunities in the world of cannabis travel and tourism.

In states which have legalized adult-use cannabis, travel sectors have been embracing it —whether with bar-style lounges, cannabis-friendly hotels, bud-and-breakfasts for weekend getaways or vacation stays, ganja-centric hiking, running, and bicycling tours, or even spiritual/meditational programs to re-set one’s soul.

Especially with COVID-19-related travel restrictions waning in the post-pandemic search for some return to social normalcy, cannabis consumers are looking for new ways to enjoy it on their terms. Since Thailand decriminalized the whole plant in June, the Southeast Asian country’s cannabis cafes have seen such a reported boom in recreational sales that its parliament is revisiting their regulations in order to clarify confusion about piecemeal restrictions.

Closer to home for American consumers, cannabis lounges are being discussed or planned in cities like Las Vegas, Boston, and Houston (for hemp-derived beverages) after the successes of social-consumption sites in states including California and Colorado.

The Lonely Planet tourism website has described cannabis tours and experiences like an “on-demand smoking lounge” in Oregon using a modular bus rented out for cannabis events, weddings, and smoke-outs. Denver-based Puff, Pass & Paint offers art-based classes and tours in more than a dozen cities. Glowing Goddess Getaways is a private, members-only social club that markets its cannabis-infused weekend retreats as “using cannabis as a creative and spiritual tool to promote sisterhood and self-love.” The business model for the Cannabis Supper Club in Los Angeles featured teams of chefs, growers, mixologists, and event specialists collaborating to present one-of-a-kind meals in private spaces to adhere any local vagaries in public consumption laws.

While stipulating that more scientific evidence in specific sport-related populations is necessary to confirm particular effects, the National Institutes of Health recognizes that “cannabidiol seems to have anti-inflammatory, neuroprotective, analgesic, anxiolytic, and pain-relieving properties which can be potential mediators of recovery in athletes during regular training and competition.” Such findings seem wholly consistent with consumers’ reported satisfaction with their consumption goals.

Catch the Recorded Webinar

It’s crucial for any cannabis business to understand consumers’ purchasing behaviors, particularly by identifying product and experience preferences. A recent webinar, “Intentional Cannabis Consumption”, featured New Frontier Data’s Chief Knowledge Officer Amanda Reiman in conversation with Jointly’s CEO and Co-Founder David Kooi, and Sara Payan, Public Education Officer at The Apothecarium in San Francisco, about findings in the report.

The industry experts considered how cannabis producers are targeting consumers looking for specific outcomes: Intentional consumption is the process of selecting cannabis products based on specific goals. What are the most common goals for cannabis consumers and which products are most effective at meeting these goals? As the cannabis industry evolves, emerging products are targeting consumers looking for specific outcomes.

The recorded 9/29 webinar is available on Equio®, our cannabis business intelligence platform. Download a complimentary copy of the report. Interested in accessing Part I of our Cannabis Consumers in America report series? Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.

The post Back to Nature: Cannabis Consumers Gain Satisfaction in Outdoor Settings appeared first on New Frontier Data.

#CBD #Hemp https://newfrontierdata.com/cannabis-insights/back-to-nature/ October 4, 2022 3:00 pm

#CBD #Hemp https://newfrontierdata.com/cannabis-insights/back-to-nature/ October 4, 2022 3:00 pm