Midterm Elections See Five States Voting on Adult-Use Cannabis

By J.J. McCoy, Senior Managing Editor, New Frontier Data

While time is still being wasted as the federal government considers how to determine its policy for legal cannabis reform, ballot initiatives next week will set how five more states proceed. Voters in each of Arkansas, Maryland, Missouri, North Dakota, and South Dakota will decide whether to join the 19 states and the District of Columbia already having legalized cannabis for adult/recreational use.

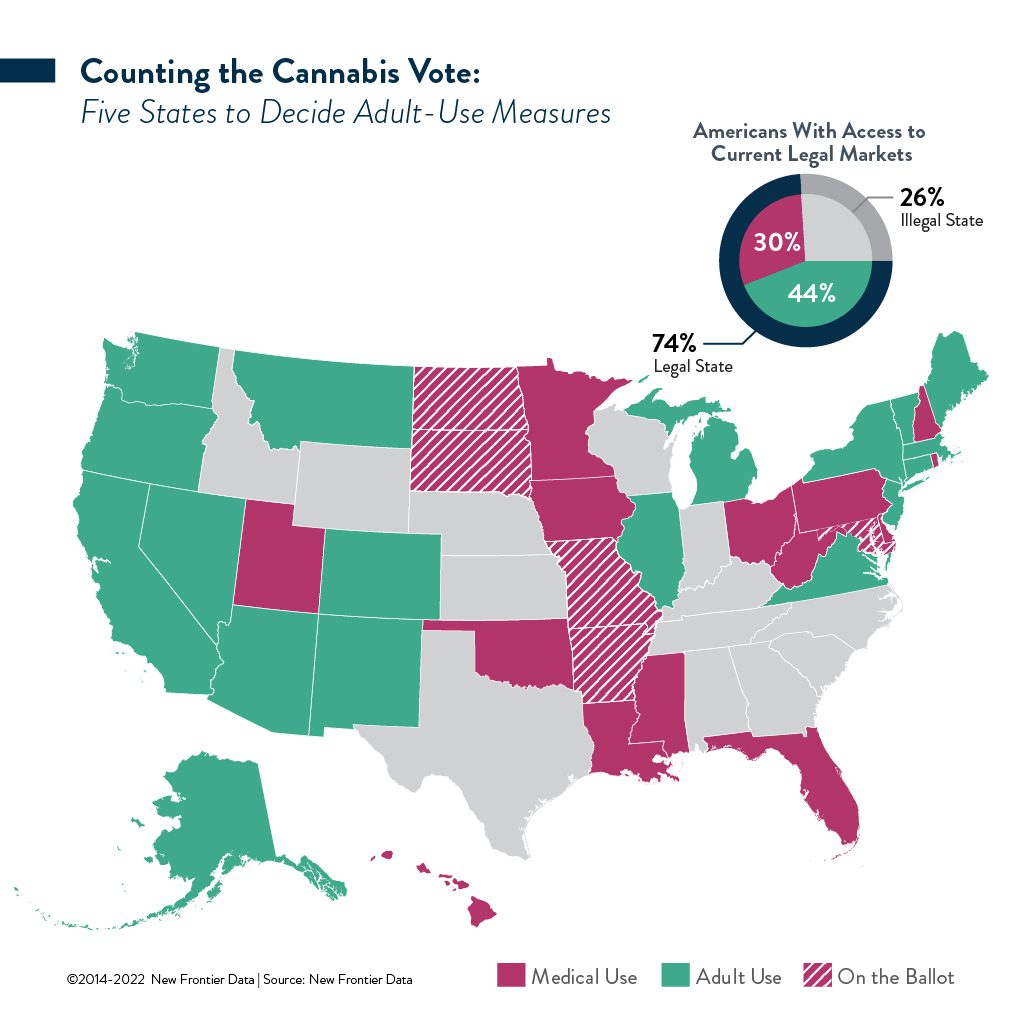

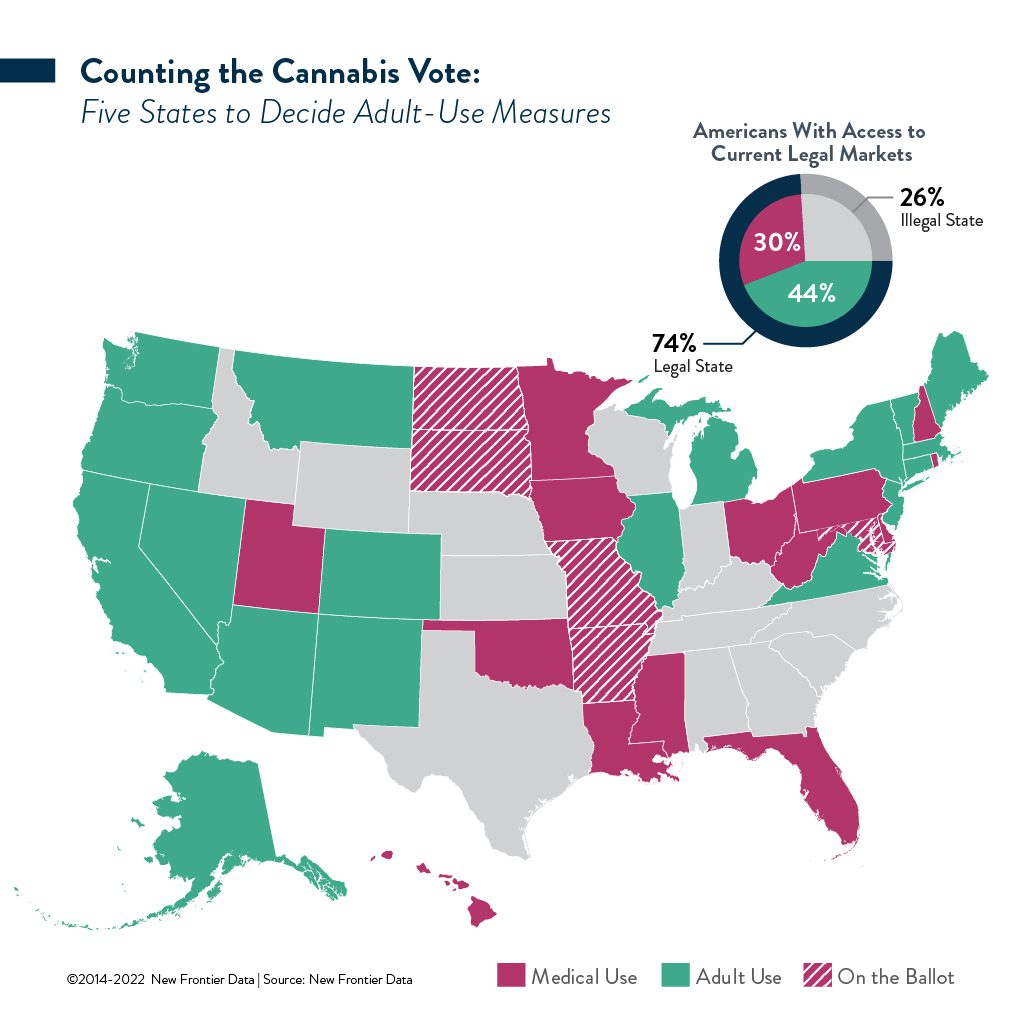

With a combined 148 million Americans living across those 19 adult-use states, and 248 million living across the 39 medical-use states, 44% of American adults now have access to legal adult-use cannabis, and nearly three-quarters (74%) of the country now have access to legal medical cannabis in some form. Conversely, 89 million Americans (26% of the U.S. population) live in states where possession and use of cannabis remain illegal: While hemp has been federally legalized, states without any legalized public-use programs for cannabis include Idaho, Indiana, Kansas, Kentucky, Nebraska, North Carolina, South Carolina, Tennessee, Texas, Wisconsin, and Wyoming.

Federally, marijuana remains classified by the Controlled Substances Act (CSA) as a Schedule I drug, alongside heroin and LSD. But President Biden’s recent decision to initiate a cannabis scheduling review – to be conducted jointly by the Drug Enforcement Agency (DEA) and the Food and Drug Administration (FDA) – stirred some momentarily renewed enthusiasm for cannabis stocks last month.

The upside in rescheduling cannabis to a less-strict category (e.g., in Schedule II alongside cocaine, or Schedule V amid cough medicines with codeine) would be to enable broad clinical research of cannabis’ medical benefits/risks. It would likely also spur vital banking reforms and open financial services to enable cannabis-related businesses with traditional forms of financing (i.e., loans, lines of credit, etc.).

Even better for the industry (though less likely to happen) would be to remove cannabis from the CSA. That would decriminalize prohibition at the federal level, and leave the regulation of cannabis to the states. Unfortunately, the lack of the very same rigorous clinical data about cannabis which federal policy has prevented for decades will likely preclude the federal authorities from going that far.

As projected by New Frontier Data, without counting any additional states’ legalizing cannabis either for medical or adult use by 2030, annual total U.S. legal sales will grow at a CAGR of 11%, reaching past $57 billion by 2030. That would mean that currently operational states could add an additional $25 billion in revenues over the next seven years, highlighting the continued growth opportunities even among well-established markets.

Given the increasing legalization of cannabis and its broader social/political acceptance, New Frontier Data expects more U.S. states and countries internationally to legalize full adult-use markets simultaneously with medical programs. As already observed, time lapses between adopted medical programs and subsequent recreational legalization in the same markets have shortened. Adoption of follow-on recreational markets has been happening more quickly, even before South Dakota in 2020 became the first state to push for legalization of both on the same ballot (passage of Initiated Measure 26 legalized medical marijuana use by qualifying patients; voters also passed Amendment A allowing the use, sale, and taxation of recreational marijuana along with medical marijuana and hemp, but in 2021 that was overturned by the State Supreme Court on technical grounds).

What’s Pending Next Week

Arkansas

Arkansas approved medical marijuana in 2016, but Issue 4 would allow for possession and use of up to one ounce of marijuana by adults aged 21 and over. The state would levy a 10% supplemental sales tax on retail sales, and earmark 30% of the revenues (15% to fund a stipend to all full-time law enforcement officers in good standing, 10% for operations of the University of Arkansas for Medical Sciences, and 5% to fund drug court programs), with the remaining 70% adding to its general fund.

Maryland

Question 4 would amend the Maryland Constitution to permit adults aged 21 or older to use and possess cannabis beginning in July 2023. It would automatically implement House Bill 837 (HB 837), detailing legal quantities for possession, along with fines for violations exceeding those restrictions. A transitional period would temporarily expand decriminalization from January 1 to June 30, 2023.

Passage of Question 4 would also direct the Maryland State Legislature to identify and implement taxes and regulations for the new market. Officials have not yet set any tax rate or structure for its cannabis market, nor have any bills identified a licensing or regulatory framework for vendors.

The measure would also automatically expunge criminal convictions for actions rendered legal under the new constitutional amendment. Individuals serving time for such offenses could file for resentencing.

Missouri

Missouri voters approved its medical cannabis program in 2018. They will now decide constitutional Amendment 3 — perhaps the most comprehensive cannabis-related measure facing voters. It specifies matters of possession, consumption, use, manufacturing, sales, delivery, taxation, and justice reforms regarding personal use of cannabis by adults ages 21 and older. Based on a 6% retail tax, state officials’ estimates project initial revenues beyond $21 million to be shared between the state ($7.9 million) and local governments ($13.8 million).

North Dakota

In North Dakota, Statutory Measure 2 would legalize the use and possession of up to one ounce of marijuana for adults aged 21 and older. The measure would also allow individuals to cultivate up to three cannabis plants at home, and set policies to regulate retail stores, cultivators, and other marijuana businesses.

The ballot measure also contains a highly controversial and patently misleading revenue estimate. The fiscal summary concludes that “the estimated fiscal impact of this measure beginning in 2023 through the 2025-2027 Biennium is Revenue of $3,145,000 and Expenses of $4,985,000.” A back-of-the-envelope calculation would thus conclude a net loss of roughly $1.8 million over five years. But in citing “too many variables”, the state’s Tax Commission neglected to include any revenue from cannabis sales in their aggregate revenue estimate: No revenue from the state’s 5% cannabis sales tax, nothing from optional 3% local sales taxes, and nothing from a potential excise tax.

Meanwhile, the state’s medical cannabis market was worth an estimated $18 million in 2021, and is expected to increase to $48 million by 2025.

South Dakota

Initiated Measure 27 aims to legalize cannabis possession, distribution, and use by adults ages 21 and older. Unlike 2020’s ill-fated Amendment A (which would have imposed a 15% cannabis sales tax), Measure 27 does not address taxation. While Amendment A passed by a 54%-46% margin two years ago, many are considering Measure 27 too close to call ahead of the voting.

Who’s Up Next?

In Oklahoma, cannabis advocates collected enough signatures to present the issue by referendum, but not in time to include it on next week’s ballot. Instead, they will vote on the measure in March 2023.

The post Midterm Elections See Five States Voting on Adult-Use Cannabis appeared first on New Frontier Data.

#CBD #Hemp https://newfrontierdata.com/cannabis-insights/midterm-elections-see-five-states-voting-on-adult-use-cannabis/ November 1, 2022 5:33 pm

#CBD #Hemp https://newfrontierdata.com/cannabis-insights/midterm-elections-see-five-states-voting-on-adult-use-cannabis/ November 1, 2022 5:33 pm